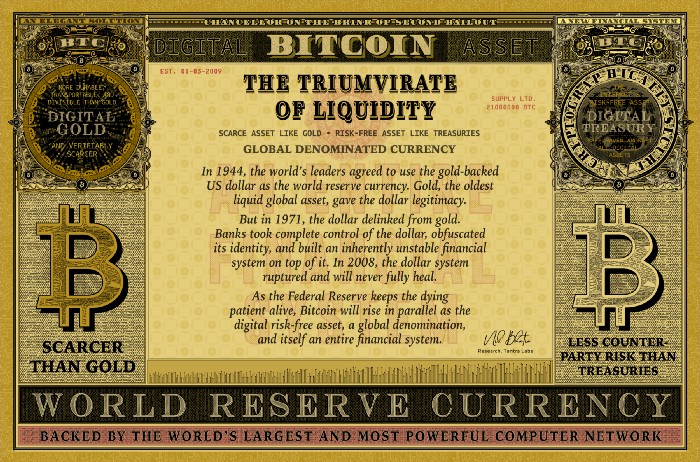

“Fiat money is the term for a medium of exchange which is neither a commercial commodity, a consumer, or a producer good, nor title to any such commodity: i.e., irredeemable paper money.”

Continuing from yesterday’s episode with Part 2 of our journey through Hoppe’s amazing piece on the nature and origins of the fiat money system. Could such a system ever work in a competitive market, or are there extremely specific conditions and legal restrictions which make the contradiction of irredeemable paper money, temporarily sustainable? Listen to find out.

“How is Fiat Money Possible.” Don’t forget to check out the vast collection of knowledge at Mises.org for this work and many more like it.

Today we reach the conclusion of Hoppe’s incredible piece on the nature of fractional reserve banking and the contradictions of fiat money. With the final section, “From Deposit & Loan Banking to Fractional Reserve: The Devolution of Credit.” Plus a really fun discussion as a follow-up to the entire, 3 part work. “How is Fiat Money Possible.” There is no place like Mises.org. Don’t forget to check out the vast collection of knowledge and information made available for free over at the Mises Institute!

Read More

Recent Comments