Bitcoin is the Great Definancialization

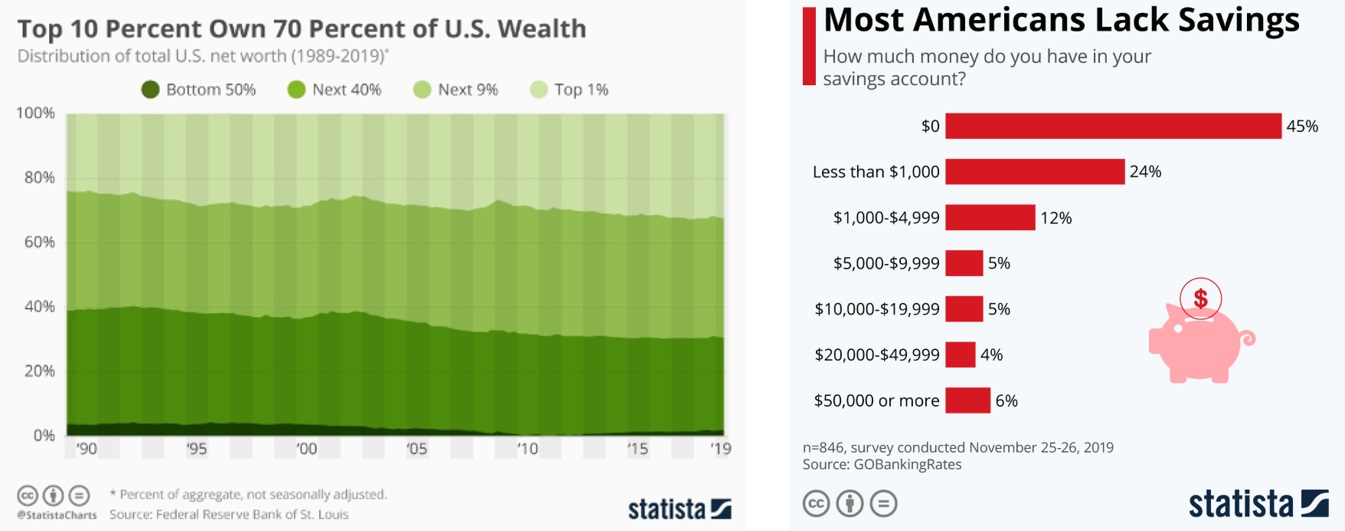

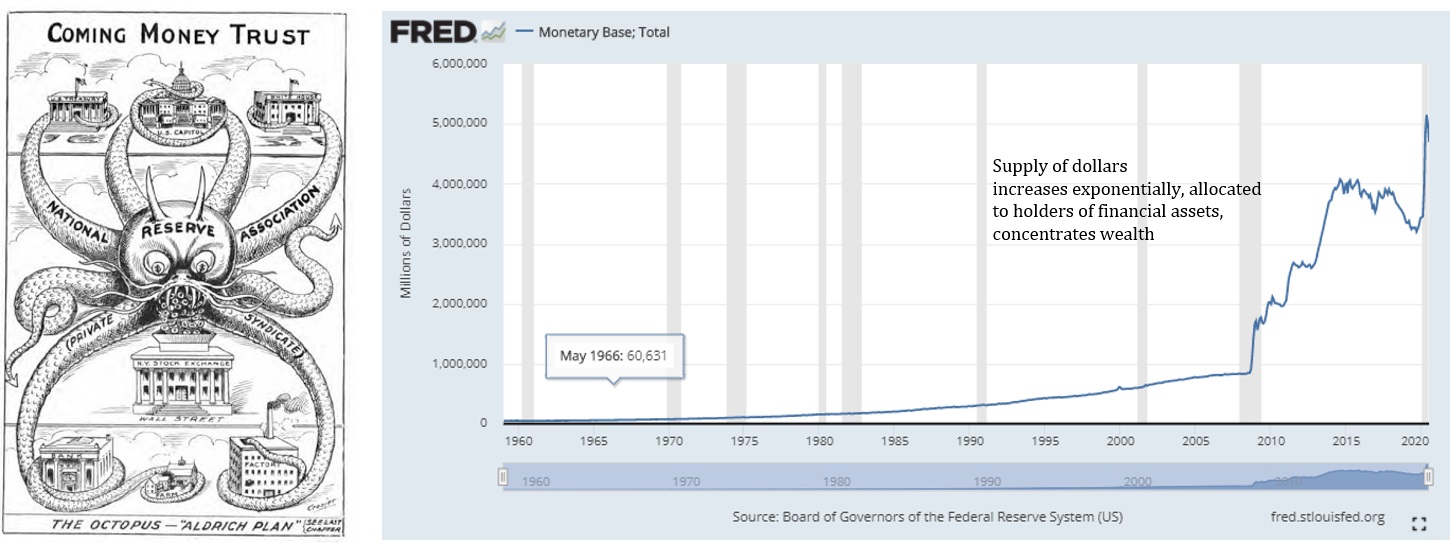

“The greatest trick that central banks ever pulled was convincing the world that individuals must perpetually take risk just to preserve value already created (and saved). It is insane, and the only practical solution is to find a better form of money which eliminates the negative asymmetry inherent to systemic currency debasement.” – Parker Lewis

Read More

Recent Comments