Economics

The Capital Strip Mine

“The most egregious falsehood regarding economic health that is nonetheless widely believed is surely that we ought to measure it by the magnitude of goods and services consumed. This is dangerous nonsense.” – Allen Farrington

Read MoreBitcoin is Venice

“Does anybody really believe that, having fully understood the choice they face, any individual would choose to save in a self-referentially mispriced toxic loan rather than a provably sound digital bearer asset? Or, more simply still, that they will think it makes less sense to hold money that is a pure asset than money that is literally defined as a liability? Why not opt into a financial system that is built on trustless verifiability rather than unverifiable trust?” – Allen Farrington

Read MoreAn Economic Analysis of Ethereum

“The annual issuance rate with all those annotations kind of looks like it was drawn by a Bitcoiner making fun of Ethereum, but instead that’s from an Ethereum source. Various Ethereum Improvement Proposals or “EIPs” by developers have changed its monetary policy over time as needed for various reasons.” – Lyn Alden

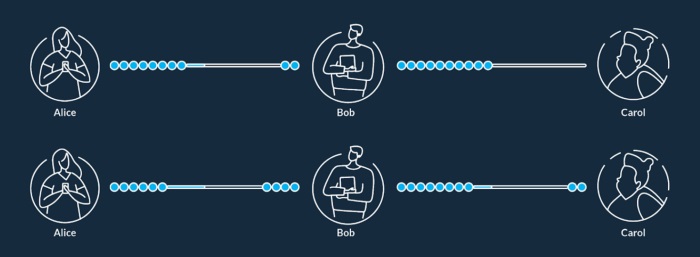

Read MoreLightning Economics: Learning to Love Inbound Liquidity

“Supplying liquidity is an investment, and we need to treat it accordingly. Like lending money or buying stock, investors commit capital for a period and expect a return that increases over time.” – Roy Sheinfeld

Read MoreHow this Bull Run is Different

“People aren’t trading bitcoin, they’re accumulating more and more of it over time and holding it long term (aka, “stacking sats“ ). This is evident not only through the raw on-chain data and exchange flows, but also through consumer behavior.” – Abhay Aluri

Read MoreBitcoin is the Great Definancialization

“The greatest trick that central banks ever pulled was convincing the world that individuals must perpetually take risk just to preserve value already created (and saved). It is insane, and the only practical solution is to find a better form of money which eliminates the negative asymmetry inherent to systemic currency debasement.” – Parker Lewis

Read MoreThe Fraying of the Petrodollar System – Part 2

“As a decentralized and open source project, adopted by many programmers and proponents around the world, many intelligent people have dedicated their careers to Bitcoin. It’s hard to find a more voracious group of people than those in the Bitcoin community, and increasingly over time, Wall Street money has poured in as well.” – Lyn Alden

Read More

Recent Comments