BITCOIN AUDIBLE

The Best in Bitcoin, Made Audible.

If you were looking for a place to begin your journey into Bitcoin, you found it. Guy Swann brings you the absolute best works and analysis explaining what it is, why it works, the technology behind it, the design trade offs, the history, the philosophy and everything else you could ask for in this foundational show in the Bitcoin world.

Our Episodes

Reads of timely and timeless Bitcoin articles, papers, books, and everything else with value to add to the bitcoin canon. Plus chats with the greatest minds in the space, breaking down the basics, destroying the FUD, enlightening the economics, and telling the story of bitcoin and liberty. With Guy’s Takes to wrap it all in a nice bow and send it home. No rock is left unturned in the Bitcoin Audible catalog.

Bitcoin & the Promise of Independent Property Rights

Does Bitcoin compete with Paypal & VISA, or something far more fundamental to human enterprise? Continuing "The Skeptics Guide to Bitcoin" series with Part 3...

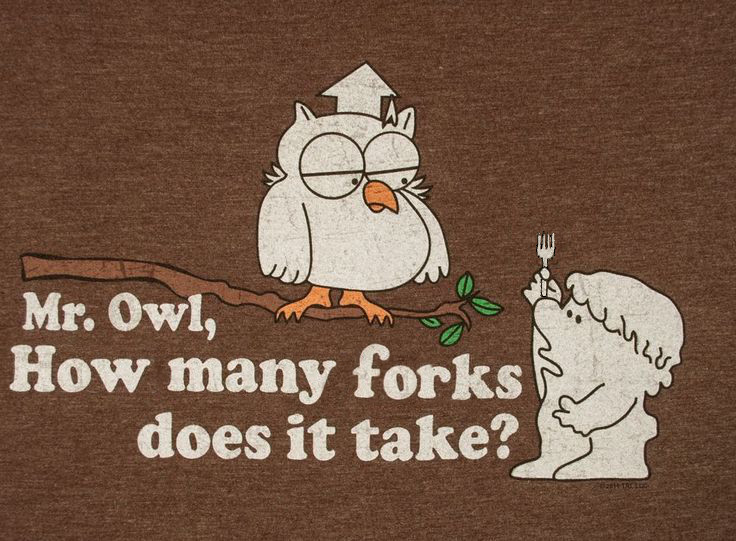

How Many Forks Does it Take to Get to the Center of Satoshi’s Vision?

By rummaging through the history and defining the philosophy of BCash and the various "big block" forks of Bitcoin, we may be able to get to the center of that elusive thing called "Satoshi's Vision"...

A Trust Model Comparison: Bitcoin vs. the Mighty Dollar

It feels like a good day for a long discussion comparing the trust model of government money, and the trust model of a decentralized, proof-of-work blockchain. Aka - Bitcoin vs. The Dollar.

The BitTorrent Lessons for Crypto Series – Parts 1-4

Bitcoin is an incredibly novel technology, there are few technologies that can boast the revolutionary impact that Bitcoin potentially has. However, there is still much to be learned from its predecessors and benefactors. Today we cover Part 2 of Simon...

The Resolution of the Big Block Experiment

If you missed the insanity that happened during the "Block Wars" that extended from 2014 all the way to late 2017 with the split of Bitcoin Cash, then you aren't going to want to miss this article. With a thorough overview of both the...

Sovereignty as a Service

Another short but excellent blog post covering the incredible work being done by the team over at @CasaHODL. For the first time we are seeing a user friendly application of one of Bitcoin's core differentiators. Sovereignty as a service is a beautifully...

“Fiat is a system, Neo.

And that system is our enemy.

You look around and what do you see? Businessman, teachers, lawyers, carpenters. All thinking that they earn for themselves. Believing the money they use is a tool of trade, not of control…”

SHOW HOST

Bitcoin Audible, Shitcoin Insider, Ai Unchained, and The Pear Report are all hosted and created by Guy Swann. Guy has been neck deep in Bitcoin since 2011 and has made it his mission to explore the technologies of freedom as he believes we are at the cusp of another technological revolution to decentralization and digital sovereignty. Filmmaker, entrepreneur, story teller, technical explorer,,, and the Guy who has read more about Bitcoin than anyone else you know.

Our Shows

Sed velit sapien, commodo et dictum porta, varius id nibh. Vivamus sed sapien molestie maximus lorem ut commodo enim.