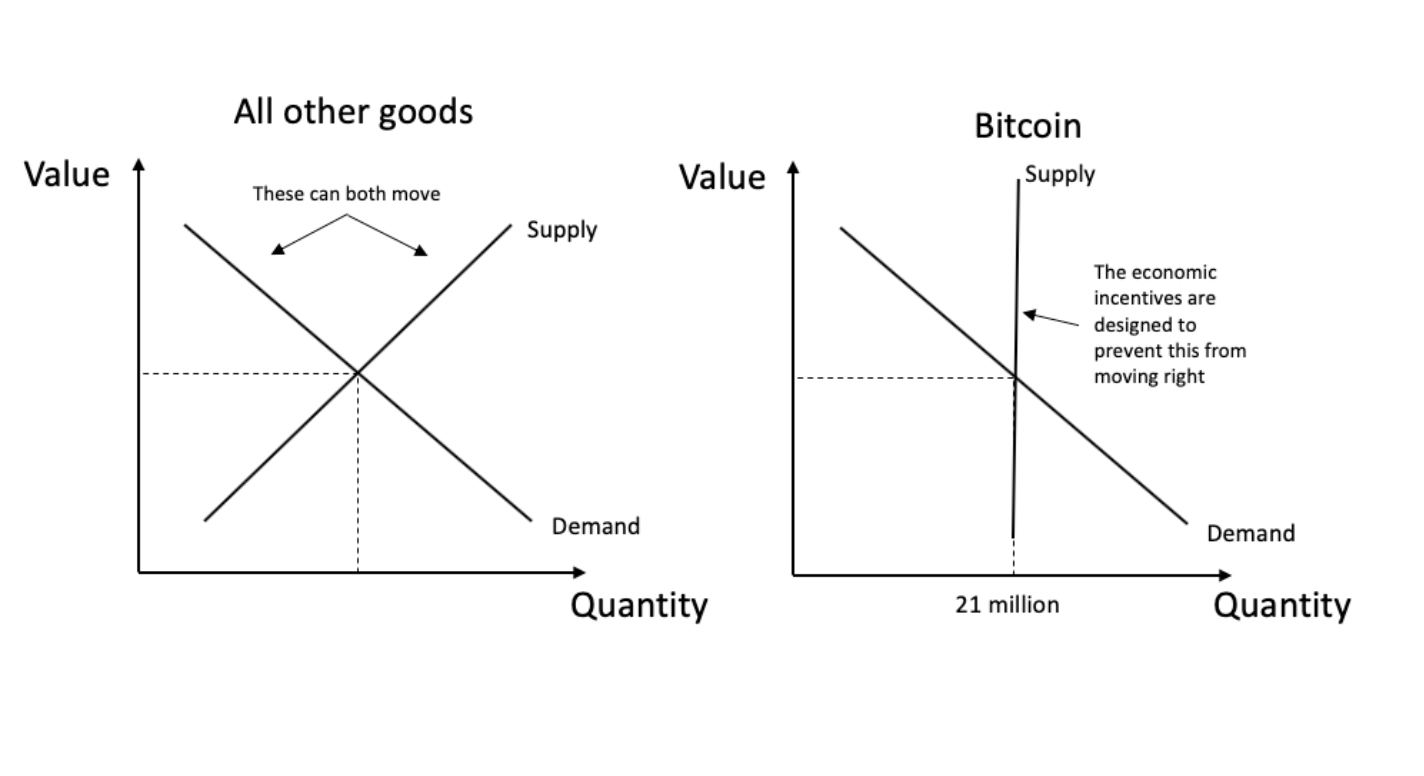

All 21M Bitcoin Already Exist

“We have nearly 11 years of empirical evidence that the network itself has been holding and transacting bitcoin, but instead of with private key signatures, it’s in exchange for hashed electricity.” – Phil Geiger

Read More

Recent Comments